Money orders have been a reliable financial instrument for decades, providing a safe and efficient way to transfer funds. In Irving, Texas, the use of money orders has become increasingly popular, especially among individuals who may not have access to traditional banking services. This article delves into the concept of money orders, their history, advantages, disadvantages, and how they function specifically within the context of Irving, TX.

What is a Money Order?

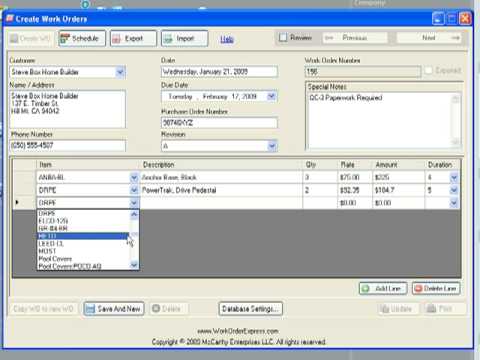

A money Order Express is a payment method that is prepaid and can be used to pay bills or send money to someone else. It is issued by a financial institution, such as a bank or credit union, or by other entities, including the United States Postal Service (USPS) and various retail outlets. The purchaser pays the full amount upfront, plus a small fee, and the money order is then issued to the recipient. Unlike checks, money orders do not require a bank account, Order Express making them accessible to a wider range of people.

A Brief History of Money Orders

The concept of money orders dates back to the late 19th century. The first money order was introduced by the USPS in 1864 as a means to facilitate safe and reliable payments, particularly for individuals without access to banking services. Over the years, the money Order Express system evolved, with various financial institutions and private companies entering the market. By the early 2000s, money orders had become a staple in the financial landscape of the United States, including in cities like Irving, TX.

The Popularity of Money Orders in Irving, TX

Irving, located in the Dallas-Fort Worth metropolitan area, is a diverse city with a population that includes many individuals and families who may prefer or require alternative payment methods. Money orders are particularly popular among those who may not have a checking account or credit card, such as immigrants, students, and low-income residents. The accessibility and security of money orders make them an attractive option for many in the Irving community.

Advantages of Using Money Orders

- Security: Money orders are considered safer than cash. If lost or stolen, they can often be replaced, unlike cash, which is gone forever.

- No Bank Account Needed: Money orders can be purchased with cash, making them accessible to those without bank accounts.

- Widely Accepted: Many businesses and organizations accept money orders as a form of payment, including utility companies, landlords, and online retailers.

- Fixed Amount: Money orders are issued for a specific amount, which helps individuals budget their expenses effectively.

- Record Keeping: Money orders provide a paper trail, which can be useful for keeping track of payments and for tax purposes.

Disadvantages of Using Money Orders

- Fees: Purchasing a money order typically involves a fee, which can vary depending on the issuer. This fee can be a drawback for those looking to minimize expenses.

- Limitations on Amount: Money orders usually have a maximum limit, often ranging from $500 to $1,000, which may not be sufficient for larger transactions.

- Processing Time: While money orders are generally processed quickly, they may still take longer than electronic payment methods.

- Potential for Fraud: Like any financial instrument, money orders can be subject to fraud. Scammers may use counterfeit money orders, which can lead to financial losses for unsuspecting victims.

How to Purchase a Money Order in Irving, TX

Purchasing a money order in Irving is a straightforward process. Here are the steps to follow:

- Choose an Issuer: Money orders can be obtained from various sources, including banks, credit unions, post offices, and retail stores. It’s important to compare fees and availability.